Key Points

- The report draws parallels between the DeFi sector’s evolution and the dot-com boom, suggesting that protocols like Aave, Maker, and Uniswap have emerged as industry leaders after surviving initial market hype.

- Multiple catalysts, including US interest rate cuts, China’s credit expansion, and advancements in DeFi infrastructure, are identified as potential drivers for a resurgence in the DeFi sector.

Apollo Crypto has released a comprehensive research report suggesting that the decentralized finance (DeFi) sector may be on the cusp of a significant resurgence. The report, titled “A DeFi Renaissance,” explores the parallels between the DeFi market’s evolution and the dot-com boom, while highlighting several catalysts that could fuel growth in the sector.

DeFi’s Evolution Mirrors Dot-Com Era

The report draws an interesting comparison between the initial hype surrounding the 2017 ICO craze and 2020’s “DeFi Summer” to the 2000 dot-com boom and bust. Just as companies like Microsoft, Amazon, and eBay emerged stronger from the dot-com crash, the report suggests that DeFi protocols such as Aave, Maker, and Uniswap have proven their market fit and established themselves as industry leaders.

Apollo Crypto notes that the aftermath of both the dot-com and DeFi booms resulted in an abundance of cheap infrastructure resources. In the case of DeFi, this has translated to affordable access to block space with improved performance, potentially fueling revenue growth for surviving protocols.

Catalysts for DeFi Growth

The report identifies several factors that could contribute to a DeFi resurgence:

- US Interest Rate Cuts: Recent rate cuts by the Federal Reserve are creating a more favorable environment for risk-on assets like crypto.

- China’s Credit Expansion: Easing policies by the People’s Bank of China could positively impact crypto markets, given the historical correlation between Bitcoin’s performance and PBOC’s asset growth.

- Weakening US Dollar: The report notes the negative correlation between the US Dollar Index (DXY) and Bitcoin’s price, suggesting potential benefits for crypto assets.

- Advancements in DeFi Infrastructure: Improvements in user experience, interoperability, scalability, smart contract security, and risk management are making DeFi more accessible and secure.

- Coinbase’s cbBTC: The report suggests that Coinbase’s tokenized Bitcoin product could potentially onboard significant capital to the DeFi sector on the Base network.

The Trinity of DeFi: Aave, Uniswap, and Maker

Apollo Crypto highlights three protocols as potential industry leaders in the next wave of DeFi growth:

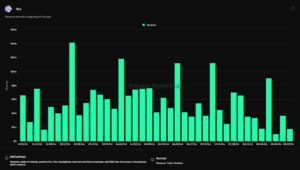

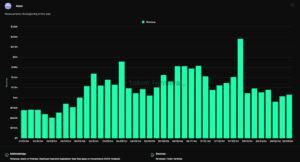

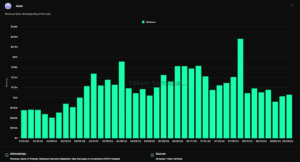

- Aave: The leading decentralized lending market, showing strong fundamental metrics and considering revenue sharing with token holders.

- Uniswap: Maintaining its position as the highest volume decentralized exchange, with ongoing innovation in its protocol and infrastructure.

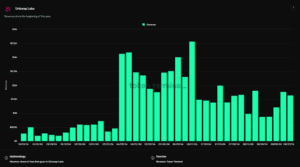

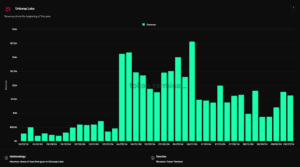

- Maker/Sky: Recently rebranded as the ‘SKY ecosystem,’ Maker is adopting a more retail-friendly and compliant approach while maintaining consistent revenue.

The report concludes that with improved infrastructure, better user experiences, and established players continuing to innovate, the DeFi sector is well-positioned for a second wave of growth. As global monetary policies shift and the crypto market matures, Apollo Crypto’s research suggests that we may indeed be witnessing the early stages of a DeFi renaissance.