Key Points

- Crypto markets face persistent liquidity fragmentation, leading to price discrepancies across exchanges and increased vulnerability to sharp price swings, especially during weekends.

- The launch of spot Bitcoin ETFs in the US has intensified weekday liquidity concentration, potentially exacerbating weekend volatility during market stress.

Liquidity Fragmentation and Its Effects

Cryptocurrency markets continue to grapple with liquidity fragmentation, a persistent issue that leads to price discrepancies across exchanges. According to a recent report by Kaiko, while these disparities have diminished over time, they remain prominent, especially on smaller, less liquid exchanges. This fragmentation becomes particularly noticeable during significant market events, such as the recent August 5, 2024 sell-off.

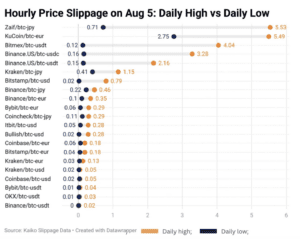

Price slippage, a key liquidity indicator, spiked across most exchanges during the August 5th sell-off. Kaiko’s data revealed that a simulated $100,000 sell order for Bitcoin (BTC) would have produced significant price slippage, varying considerably depending on the exchange and trading pair. Zaif’s BTC-JPY pair experienced the highest slippage, while KuCoin’s BTC-EUR pair exceeded 5%. Even typically liquid stablecoin-quoted pairs on platforms like BitMEX and Binance US saw notable increases in slippage.

Impact of US Spot Bitcoin ETFs

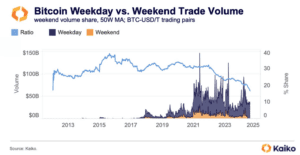

The launch of spot Bitcoin exchange-traded funds (ETFs) in the United States has significantly impacted market dynamics. Since their introduction in January 2024, these ETFs have drawn in $17.3 billion in net inflows and currently hold about 4.7% of Bitcoin’s supply. This development has intensified liquidity concentration during weekdays, particularly in BTC-USD markets.

According to Kaiko’s report, the shift towards weekday trading “heightens the risk of sharp weekend price swings during market stress.” Unlike traditional markets that close on weekends, crypto markets operate 24/7, causing sell-offs that start on a Friday to worsen weekend uncertainty and potentially amplify price impacts.

Case Study: Recent Market Sell-Off

The recent sell-off on August 5, 2024, provides a clear example of the market dynamics. Bitcoin moved 14% between the US market close on Friday, August 2, to its reopening on Monday, August 5. This movement was similar to major sell-offs observed since 2020.

During this event, BTC prices on Binance.US diverged significantly from those on more liquid platforms. This discrepancy is partly attributed to Binance.US’s reduced liquidity following the SEC’s June 2023 lawsuit. The platform currently processes only $20 million daily trade volume, down from $400 million in early 2023.

Infrastructure Improvements and Future Outlook

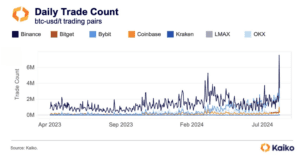

Despite these challenges, there are positive developments in the crypto market infrastructure. Cryptocurrency platforms have invested heavily in their systems, enabling them to handle increased trade volumes without experiencing outages. This improvement has helped lower the cost of exploiting arbitrage opportunities between exchanges.

During the recent sell-off, BTC-USD and BTC-USDT trade counts hit record highs on several major exchanges. Bybit saw all-time highs, while Coinbase reached post-FTX collapse levels, and Kraken experienced its highest activity since June 2022.

As the crypto market evolves, addressing liquidity fragmentation remains a crucial challenge. The interplay between traditional finance, as represented by the new Bitcoin ETFs, and the 24/7 nature of crypto markets will likely continue to shape market dynamics in the coming years.