Key Points

- The CFTC’s proposed rule to ban event contracts on prediction markets, including those for elections, has sparked widespread opposition from crypto exchanges and industry leaders.

- Supporters of prediction markets argue they offer transparency and integrity, while critics, including some U.S. lawmakers, fear they could interfere with elections and erode public trust.

In a united front, major players in the cryptocurrency and fintech industries are voicing strong opposition to a proposed rule change by the U.S. Commodity Futures Trading Commission (CFTC) that could effectively ban prediction markets, including those focused on political outcomes.

The proposal, which aims to clarify the definition of prohibited “event contracts,” has drawn criticism from prominent exchanges such as Gemini, Crypto.com, Coinbase, Robinhood and influential figures in the crypto space.

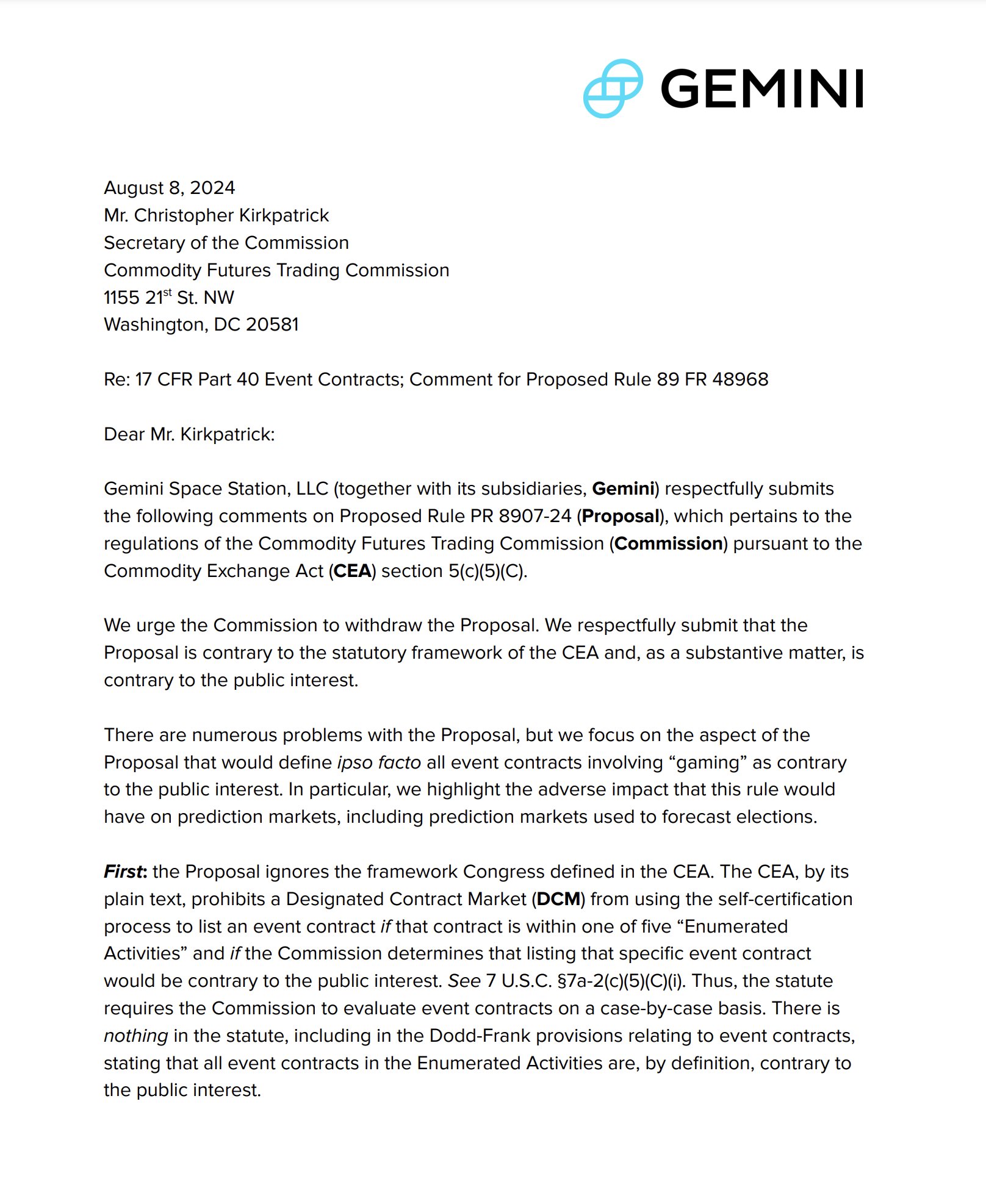

Gemini, in an August 8 letter to CFTC Secretary Christopher Kirkpatrick, urged the commission to withdraw the proposed rule, emphasizing the “adverse impact” it would have on prediction markets, particularly those used for election forecasting. Gemini co-founder Cameron Winklevoss took to social media to further elaborate on the importance of crypto prediction platforms like Polymarket, highlighting their transparency and integrity.

Source: Gemini

“Unlike polls, pundits, or expert opinions, they require participants to put their money where their mouth is — to have skin in the game,” Winklevoss stated in an August 9 post on X (formerly Twitter). He argued that decentralized prediction markets represent a significant innovation with real public utility.

Coinbase’s chief legal officer, Paul Grewal, echoed these sentiments, stating that the proposal fails to recognize the public benefits of prediction markets. He called for the CFTC to withdraw the proposal and collaborate with stakeholders to develop a more balanced approach.

The opposition extends beyond major exchanges. Crypto.com SVP Steve Humenik submitted a comment questioning the CFTC’s authority to implement such a ban. Dragonfly Capital’s legal team raised concerns about the commission’s jurisdiction in light of recent Supreme Court decisions.

However, the proposed rule change has supporters, particularly among U.S. lawmakers. Five senators and three representatives recently renewed calls for the CFTC to ban betting on the 2024 presidential election. In an August 5 letter to CFTC Chair Rostin Benham, they argued that such markets “could influence and interfere with elections and further erode public trust in democracy.”

The lawmakers expressed concerns about the potential for these markets to exacerbate existing issues in the political system, such as the influence of dark money and the threat of extremism. They emphasized the need to protect the integrity of the electoral process as the 2024 election approaches.

This clash between industry innovators and regulatory bodies highlights the ongoing debate surrounding the role of prediction markets in modern democracy. Proponents argue that these platforms offer transparency and accountability that traditional polling and punditry lack. Critics, however, fear the potential for manipulation and the erosion of public trust in democratic institutions.

As the CFTC considers its next steps, the crypto industry remains firm in its stance. Many call for a collaborative approach, urging the commission to engage with academic, industry, and policy stakeholders to develop regulations that balance innovation with public interest protection.

The outcome of this regulatory battle could have far-reaching implications for the future of prediction markets in the United States and potentially shape the landscape of political forecasting and public engagement with electoral processes.