Key Points

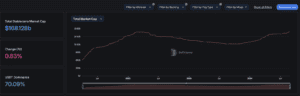

- The stablecoin market cap reached a record $168 billion after 11 consecutive months of growth, surpassing the previous peak from March 2022.

- USDC shows significant resurgence with six consecutive months of growth, while Tether (USDT) reports record quarterly profits of $4.52 billion in Q1 2024.

Stablecoin Sector Demonstrates Remarkable Resilience

In a significant milestone for the cryptocurrency ecosystem, the total market capitalization of stablecoins has hit an all-time high of $168 billion, according to the latest data from DefiLlama. This unprecedented achievement comes after nearly a year of consistent growth, marking a robust recovery and renewed confidence in the stablecoin sector.

The current market cap surpasses the previous record set in March 2022, highlighting the sector’s resilience and ability to rebound from market downturns. Notably, this figure excludes algorithmic stablecoins, focusing solely on asset-backed stablecoins pegged to external assets like fiat currencies or commodities.

Market Recovery and Growth Trends

According to CCData’s May 2024 report, the stablecoin market has been on an upward trajectory for eight consecutive months. In May alone, the total market capitalization rose by 0.63% to $161 billion, marking the highest level since April 2022. This sustained growth indicates a full recovery from the losses incurred following the collapse of TerraUSD, which had initiated a seventeen-month downtrend.

Tether (USDT) Dominance and Record-Breaking Profits

Tether (USDT) continues to dominate the stablecoin landscape, demonstrating unprecedented financial strength and market presence. According to Tether’s Q2 2024 attestation report, the company achieved several significant milestones:

- Record-breaking profits: Tether reported a net operating profit of $1.3 billion in Q2 2024, contributing to a total net profit of $5.2 billion for the first half of 2024.

- Unprecedented Treasury holdings: Tether’s direct and indirect ownership of U.S. Treasuries surpassed $97.6 billion, a new all-time high. This positions Tether as the 18th largest holder of U.S. debt globally, surpassing countries like Germany, the United Arab Emirates, and Australia.

- Increased market cap: USDT’s market capitalization continued its upward trend, with over $8.3 billion in USDt issued in Q2 2024. The total reserves for Tether tokens in circulation amounted to $118.4 billion as of June 30, 2024.

- Strong financial position: The Group’s consolidated equity reached an impressive $11.9 billion, with assets exceeding liabilities by $5.3 billion.

These figures underscore Tether’s dominant position in the stablecoin market and reflect the growing adoption and trust in USDT. The company’s substantial profits and strategic investments in various sectors, including AI, biotech, and telecommunications, further solidify its role as a leader in the stablecoin industry.

USDC’s Resurgence

While Tether maintains its lead, USD Coin (USDC) has shown significant signs of resurgence. According to the CCData report, USDC’s market capitalization rose for the sixth consecutive month, reaching $32.6 billion in May. This growth coincides with increased demand for the stablecoin, as evidenced by USDC pairs recording all-time high monthly trading volumes in March. The stablecoin’s market share by trading volume has also seen an uptick, rising for the second consecutive month to 8.27%.

Implications for the Broader Crypto Market

The surge in the stablecoin market cap has significant implications for the broader cryptocurrency landscape. Stablecoins play a crucial role in providing liquidity, facilitating trading, and offering a hedge against volatility in crypto markets. The sustained growth in stablecoin adoption could signal increasing institutional interest and a maturing cryptocurrency market.

Moreover, the rise in stablecoin usage may also reflect a growing demand for digital payment solutions and cross-border transactions, highlighting the potential for stablecoins to bridge the gap between traditional finance and the crypto world.

Regulatory Considerations

As the stablecoin market continues to grow, it’s likely to attract increased attention from regulators and policymakers. The unprecedented growth may accelerate discussions around stablecoin regulation and its integration into the broader financial system. Stakeholders will be watching closely to see how regulatory frameworks evolve to address the expanding role of stablecoins in the global financial ecosystem.

Looking Ahead

The record-breaking stablecoin market cap represents a pivotal moment for the crypto industry. It demonstrates the sector’s ability to recover from setbacks and suggests growing confidence in digital assets. As stablecoins continue to play an increasingly important role in crypto and traditional finance, their growth trajectory will be a key indicator of the overall health and direction of the digital asset market.

With this new milestone, the crypto community eagerly anticipates the potential for further adoption and integration of stablecoins into mainstream financial systems, potentially reshaping the future of global transactions and digital finance.