Key Points

- The SEC imposed a record-breaking $4.68 billion in fines on crypto firms in 2024, accounting for 63% of all crypto-related fines since 2013 and marking a 3018% increase from 2023.

- Terraform Labs and its co-founder Do Kwon received the largest single fine in crypto history at $4.68 billion, setting a new precedent for regulatory penalties in the industry.

SEC Fines Surge to Unprecedented Levels

The U.S. Securities and Exchange Commission (SEC) has dramatically intensified its regulatory actions against the cryptocurrency industry, with fines reaching astronomical levels in 2024 and according to a report by Social Capital Markets, the SEC levied a staggeri

ng $4.68 billion in penalties against crypto firms and individuals in 2024 alone, dwarfing previous years’ enforcement actions.

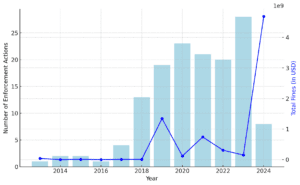

This figure represents a massive 3018% increase from the $150.26 million in fines issued in 2023, signaling a seismic shift in the regulatory landscape. The report reveals that since 2013, the SEC has imposed over $7.42 billion in total fines on the crypto industry, with 2024 accounting for 63% of this amount.

Terraform Labs Case Sets New Precedent

At the heart of 2024’s enforcement surge is the unprecedented $4.68 billion fine against Terraform Labs PTE, Ltd. and its co-founder, Do Kwon. This single case stemmed from allegations of misleading investors and offering unregistered securities, which has set a new benchmark for regulatory penalties in the crypto space.

The Terraform Labs case underscores the SEC’s growing willingness to impose severe financial consequences for what it perceives as serious infractions. It also highlights the increasing risks crypto firms face in a rapidly evolving regulatory environment.

Shifting Enforcement Strategies

The report’s analysis reveals a clear trend in the SEC enforcement approach. While the number of enforcement actions has fluctuated over the years, the average fine amount has risen dramatically. In 2018, the average fine was $3.39 million. By 2024, this figure had skyrocketed to $426 million, representing a staggering 12,466% increase.

This shift suggests that the SEC is focusing its resources on high-profile cases and major industry players rather than pursuing a larger number of smaller violations. The strategy appears aimed at setting precedents and sending a strong message to the entire crypto ecosystem about the importance of regulatory compliance.

As the cryptocurrency industry continues to evolve, this report is a stark reminder of growing financial and legal risks related to non-compliance. It underscores the critical need for crypto firms to prioritize regulatory adherence and transparency in their operations, as the cost of falling afoul of the SEC has never been higher.