Key Points

- Germany’s Federal Office for Information Security (BSI) advises that hardware wallets are the most secure option for storing cryptocurrency.

- The BSI warns against the use of exchange-linked wallets due to their vulnerability to hacking attempts.

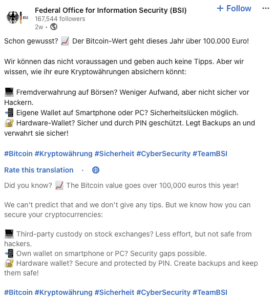

Germany’s Federal Office for Information Security (BSI), the country’s leading cybersecurity agency, has issued recommendations on the safest methods for storing cryptocurrencies. In a recent LinkedIn post, the BSI emphasized the superiority of hardware wallets over other storage options, citing their enhanced security features.

BSI Highlights Risks of Popular Storage Methods

The agency’s guidance comes amidst growing concerns about the security of digital assets. The BSI addressed several common storage methods used by cryptocurrency holders, starting with exchange-linked or “hot” wallets. While acknowledging their convenience, the agency warned that these wallets pose significant security risks due to their constant internet connectivity, making them prime targets for hackers.

The BSI also commented on self-custodial wallets installed on personal computers or smartphones. Although these offer users more control over their private keys, the agency noted that they still suffer from potential security gaps. The BSI cautioned that these devices could be compromised by malware designed to steal private keys, putting users’ holdings at risk.

Hardware Wallets: BSI’s Recommended Solution

In contrast to other methods, the BSI strongly endorsed hardware wallets as the most secure option for cryptocurrency storage. These physical devices, which store private keys offline and are protected by PIN authentication, offer a robust defense against unauthorized access and cyber attacks.

Additional Security Measures Advised

While recommending hardware wallets, the BSI also stressed the importance of additional security measures. The agency advised users to create backups of their seed phrases or private keys and store these backups in a secure location separate from the primary storage device. This precaution, according to the BSI, ensures that users can recover their assets in case of device loss or failure.

The BSI’s recommendations come at a time when the cryptocurrency market continues to grow and attract both individual and institutional investors. As digital assets become more mainstream, the need for secure storage solutions has never been more critical.

As the cryptocurrency landscape evolves, the BSI’s guidance serves as a reminder of the ongoing need for vigilance in digital asset security. This is especially important when considering the current trends in crypto scams and crypto crime.

The agency’s endorsement of hardware wallets may influence both individual practices and institutional policies regarding cryptocurrency storage in Germany and beyond.