Key Points

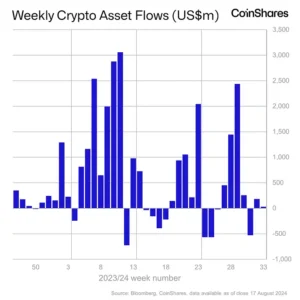

- Digital asset investment products saw minor inflows of $30 million last week, masking significant shifts between providers and regional disparities.

- Solana experienced its largest outflows on record at $39 million, driven by a sharp decline in memecoin trading volumes.

Overall, Market Sentiment Remains Cautious

According to the latest CoinShares Weekly Report, the cryptocurrency market witnessed modest inflows of $30 million into digital asset investment products last week. This figure, however, belies the complex dynamics at play, with established providers losing ground to newer entrants in the market.

James Butterfill, the report’s author, noted that weekly trading volumes on investment products fell by nearly 50% compared to the previous week, reaching $7.6 billion. This decline is attributed to recent macroeconomic data suggesting a reduced likelihood of a 50 basis point interest rate cut by the Federal Reserve in September.

Regional Disparities and Bitcoin’s Resilience

The report highlights significant regional variations in investment flows. While the United States, Canada, and Brazil saw inflows of $62 million, $9.2 million, and $7.2 million, respectively, Switzerland and Hong Kong experienced notable outflows totaling $30 million and $14 million.

Bitcoin remained a favored asset, attracting the largest inflows at $42 million. Interestingly, short-bitcoin ETFs saw outflows for the second consecutive week, totaling $1 million, potentially indicating a shift in investor sentiment towards a more bullish outlook on the leading cryptocurrency.

Ethereum’s Hidden Turmoil and Solana’s Setback

Ethereum’s modest $4.2 million inflow masks significant underlying shifts. New providers saw substantial inflows of $104 million, while Grayscale experienced hefty outflows of $118 million, highlighting the changing landscape of Ethereum investment products.

The most striking development was Solana’s record outflows of $39 million. This setback is attributed to a sharp decline in trading volumes of memecoins, a sector on which Solana’s ecosystem heavily relies. This event underscores the potential vulnerabilities of blockchain platforms that become overly dependent on specific types of tokens or applications.

As the crypto market navigates through these complex dynamics, investors and analysts will closely watch how different assets and ecosystems adapt to changing market conditions and investor preferences.