Key Points

- Hougan predicts a significant crypto market rally, citing improving macroeconomic conditions and increasing institutional adoption as primary drivers.

- The Bitwise CIO emphasizes the transformative potential of blockchain technology beyond cryptocurrencies, highlighting its applications in various industries.

Macroeconomic Factors Fuel Optimism

Matt Hougan, Chief Investment Officer at Bitwise, has presented a bullish analysis of the cryptocurrency market. He points to several macroeconomic factors that he believes will drive substantial growth in the coming months. Hougan argues that easing inflationary pressures and a potential shift in monetary policy could create a favorable environment for crypto assets.

“We’re seeing signs of inflation cooling down, which could lead to a more accommodative stance from central banks,” Hougan explained. “This macroeconomic backdrop, combined with the increasing institutional interest in crypto, sets the stage for a potential rally.”

Institutional Adoption Gains Momentum

One key pillar of Hougan’s optimistic outlook is the accelerating pace of institutional adoption in the cryptocurrency space. He notes that major financial institutions and corporations are investing in cryptocurrencies and exploring blockchain technology for various applications.

“The entry of traditional finance giants into the crypto market is a game-changer,” Hougan stated. “We’re witnessing a shift from skepticism to embracement, which could drive significant capital inflows into the sector.”

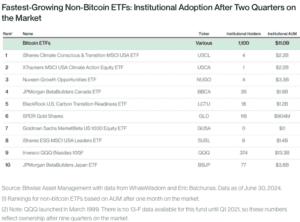

This trend is clearly illustrated by recent data on non-Bitcoin ETFs. According to a graph from Bitwise Asset Management, several climate-focused and ESG ETFs show significant institutional adoption just two quarters after their market launch. For instance, the iShares Climate Conscious & Transition MSCI USA ETF (USCL) and the Nuveen Growth Opportunities ETF (NUGO) have each attracted four institutional holders and manage $2.2B and $3.3B in assets, respectively.

Beyond Bitcoin: The Broader Blockchain Ecosystem

While much of the crypto world’s focus remains on Bitcoin and other prominent cryptocurrencies, Hougan emphasizes the importance of looking at the broader blockchain ecosystem. He believes that blockchain technology’s true potential extends far beyond digital currencies.

“Blockchain is poised to revolutionize numerous industries, from supply chain management to healthcare and beyond,” Hougan asserted. “As these real-world applications gain traction, we’ll likely see a ripple effect throughout the entire crypto market.”

The data on non-Bitcoin ETFs supports this view, showing significant institutional interest in funds focused on climate action, growth opportunities, and ESG factors. This suggests that investors look at blockchain and related technologies as tools for addressing broader economic and environmental challenges.

Hougan’s analysis and the emerging data on institutional adoption provide a comprehensive view of the crypto landscape, highlighting both short-term market dynamics and long-term technological trends. As the industry evolves, these insights offer valuable perspectives for investors and enthusiasts alike.