Key Points

- Despite a 20% decrease in illicit on-chain activity, stolen funds and ransomware attacks have surged in 2024. Stolen funds nearly doubled to $1.58 billion, while ransomware payments increased by 2% to $459.8 million.

- Cybercriminals frequently target centralized exchanges, leveraging sophisticated social engineering tactics. In 2024, the largest single ransomware payment ever recorded reached $75 million.

Overall Crypto Landscape

According to a recent report by Chainalysis, 2024 has seen both positive developments and concerning trends in the cryptocurrency ecosystem. While crypto continues to gain mainstream acceptance, evidenced by the approval of spot Bitcoin and Ethereum ETFs in the United States, cybercrime-related activities have shown worrying patterns.

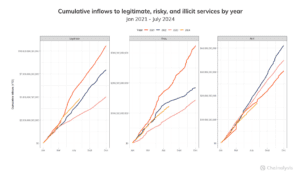

The report highlights that inflows to legitimate services are at their highest since the 2021 bull market peak, indicating continued global adoption of cryptocurrencies. However, inflows to risky services, primarily mixers, and exchanges without KYC procedures, are trending higher than the previous year.

Rise in Stolen Funds and Exchange Attacks

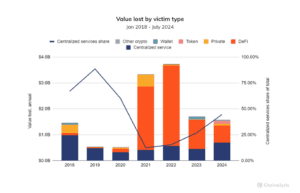

One of the most significant trends observed in 2024 is the surge in stolen funds from crypto heists. The total value stolen nearly doubled year-over-year, reaching $1.58 billion through the end of July. Interestingly, while the number of hacking incidents only marginally increased (2.76% YoY), the average amount stolen per event rose by a staggering 79.46%, from $5.9 million to $10.6 million.

Chainalysis notes that crypto thieves are “returning to their roots” by targeting centralized exchanges more frequently. This shift comes after several years of focusing on decentralized finance (DeFi) protocols. The report mentions the DMM hack, which resulted in a loss of $305 million, accounting for roughly 19% of the total value hacked in 2024.

Ransomware: Record-Breaking Year in Progress

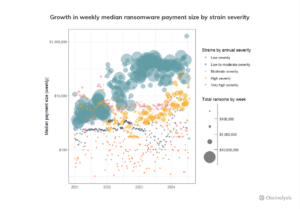

2024 is on track to become the highest-grossing year for ransomware attacks. Through June 2024, ransomware payments totaled $459.8 million, slightly surpassing the $449.1 million recorded in 2023. This trend suggests that 2024 could exceed the record set in 2023 when ransomware payments surpassed $1 billion.

The report highlights a concerning trend in ransomware attacks:

- The largest single ransomware payment ever recorded reached approximately $75 million, paid to a group known as Dark Angels.

- The median ransom payment for the most severe strains has increased from just under $200,000 in early 2023 to $1.5 million in mid-June 2024.

These figures suggest that ransomware groups increasingly target larger businesses and critical infrastructure providers, which may be more likely to pay substantial ransoms due to their financial resources and systemic importance.

Changing Dynamics in the Cybercrime Landscape

The Chainalysis report also sheds light on the evolving tactics of cybercriminals:

- Advanced cybercriminals, including those linked to North Korea, are increasingly using off-chain methods such as social engineering to infiltrate crypto-related services.

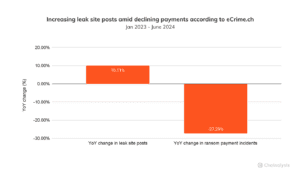

- The ransomware ecosystem has become more fragmented following law enforcement disruptions of major players like ALPHV/BlackCat and LockBit.

Despite the increase in attack frequency and severity, there is a silver lining. The report suggests that victims pay ransoms less often, potentially indicating better preparedness and resilience among targeted organizations.

Conclusion

While illicit activity in the crypto ecosystem is declining overall, the rise in stolen funds and ransomware attacks presents significant challenges. Cybercriminal groups’ sophistication and ability to adapt to new security measures underscore the need for continued vigilance and improved security practices across the cryptocurrency industry.

As the crypto landscape continues to evolve, Chainalysis’s insights highlight the importance of ongoing efforts to combat cybercrime and protect users and institutions in the digital asset space.