Key Points

- Stripe has reinstated cryptocurrency payment support for U.S. businesses, allowing them to accept USDC on Ethereum, Solana, and Polygon networks.

- This marks Stripe’s return to crypto payments after discontinuing Bitcoin support in 2018, signaling a renewed interest in digital currency transactions.

Stripe Embraces Stablecoins for Payments

Stripe, the global payment processing giant, has announced the reintroduction of crypto payments for U.S. businesses. As of October 10, 2024, merchants can now accept payments in USDC, a popular stablecoin, through the Ethereum, Solana, and Polygon blockchain networks.

This development comes six years after Stripe ended its support for Bitcoin payments in 2018. The company’s decision to re-enter the crypto space with stablecoin support reflects the evolving landscape of digital currencies and their increasing adoption in mainstream finance.

A New Era of Crypto Integration

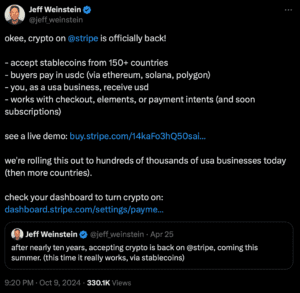

Jeff Weinstein, Stripe’s product lead, detailed that the new integration works seamlessly with the company’s existing products, including checkout, elements, and payment intents. He also revealed plans to extend this functionality to Stripe’s subscription features in the near future.

The reintroduction of crypto payments allows U.S. businesses to accept USDC from customers in over 150 countries. Importantly, merchants will receive payments in U.S. dollars, mitigating concerns about cryptocurrency volatility that led to the discontinuation of Bitcoin support in 2018.

Industry Reactions and Implications

The announcement has been met with enthusiasm from key players in the cryptocurrency space. Jeremy Allaire, CEO of Circle, the company behind USDC, expressed excitement about the official launch and support for USDC payments in Stripe products for U.S. businesses.

Stripe’s move signifies a broader trend of traditional financial services companies re-evaluating their stance on cryptocurrencies, particularly stablecoins. By choosing USDC, which is pegged to the U.S. dollar, Stripe addresses previous concerns about price volatility while still embracing the benefits of blockchain technology for cross-border transactions.

As the first major payments company to reintroduce crypto support on this scale, Stripe’s decision could potentially influence other players in the industry to follow suit, further bridging the gap between traditional finance and the world of cryptocurrencies.