Key Points

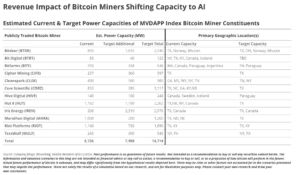

- VanEck research suggests Bitcoin miners could significantly boost their revenue by leveraging their energy infrastructure for AI and high-performance computing (HPC). The estimated net present value could reach $37.6 billion if miners convert 20% of their capacity to AI/HPC by 2027.

- An arbitrage opportunity may exist between Bitcoin miners and AI data centers, with miners currently valued at ~$4.5M per megawatt of installed capacity compared to over $30M per megawatt for some data center stocks.

A recent report by VanEck highlights a potentially game-changing opportunity for Bitcoin miners: leveraging their existing energy infrastructure to serve the rapidly growing artificial intelligence and high-performance computing (AI/HPC) market. This strategic shift, if implemented, could unlock substantial new revenue streams for miners and create a unique arbitrage opportunity in the tech sector.

The synergy is straightforward: AI companies need energy, and Bitcoin miners have it in abundance. With North American grid interconnection queues now exceeding four years, existing Bitcoin mining sites could be uniquely positioned to support AI/HPC operations almost immediately, if properly equipped.

Source: VanEck

Early Adopters and Potential Benefits

While most miners have yet to make this pivot, some early adopters are already seeing benefits. Core Scientific (CORZ), the fourth-largest Bitcoin miner by hash rate, recently secured a 12-year contract with AI hyperscaler CoreWeave. This deal is projected to generate over $3.5 billion in revenue for providing 200 MW of infrastructure. Following the announcement, CORZ has added $1.6B to its market cap, with its shares significantly outperforming the MarketVector Digital Asset Equity Index.

Quantifying the AI/HPC Opportunity

VanEck’s analysis attempts to quantify the potential size of the AI/HPC opportunity for Bitcoin miners. Assuming a revenue rate of $1.30 per kWh and an 80% utilization rate, the firm projects an annualized revenue of approximately $9.11 million per megawatt.

However, the capital requirements for such a pivot would be substantial. VanEck estimates a conversion cost of $7.5 million per megawatt, totaling ~$23.1 billion for infrastructure alone. Additionally, the model assumes a need for 1,681,600 Nvidia H100 GPUs, costing ~$54.7 billion for the first generation.

Financial Overview, AI/HPC Strategies, & Estimated Upside Potential Among MVDAPP Index Publicly Traded Bitcoin Miners (2024)

Source: VanEck

Challenges and Considerations

While the potential rewards are significant, Bitcoin miners would face several challenges in an AI pivot. Only a small percentage of existing mining centers have the necessary infrastructure for AI/HPC conversion. Moreover, established hyperscalers like Equinix already benefit from years of operational expertise and customer trust.

Despite these hurdles, some miners are beginning to explore complementary strategies. Iris Energy, Terawulf, and Hut 8 have all announced plans to investigate cloud services and AI infrastructure development.

Implications for the Energy Sector

The potential trend is also attracting attention from grid operators. Bitcoin miners’ ability to curtail consumption during peak demand makes them attractive partners for managing electrical grids. For instance, Riot earned $71.2 million in power credits from ERCOT in 2023, generating over 25% of its revenue. A pivot to AI could further enhance this flexibility.

Looking Ahead

As this potential trend develops, it could represent a significant merger of two high-growth tech sectors. VanEck believes that if executed successfully, the miners in the MarketVector Digital Asset Equity Index could potentially double their market capitalization by 2028, even assuming no growth in Bitcoin profits.

However, it’s important to note that this is still largely theoretical. While some miners are exploring AI opportunities, a large-scale pivot has yet to occur. The coming years will reveal whether Bitcoin miners can successfully capitalize on this potential new revenue stream.