Key Points

- A massive $1.88 billion in crypto options are set to expire today (Friday), with Bitcoin options accounting for $1.4 billion.

- The Bitcoin price may face downward pressure if it fails to recover above $60,000 before the expiry at 8:00 AM UTC.

Looming Options Expiry

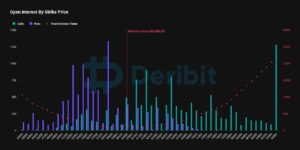

Cryptocurrency traders are bracing for potential market volatility as a significant options expiry approaches. According to data from Deribit, approximately $1.88 billion in crypto options are set to expire today at 8:00 AM UTC. This expiry could have substantial implications for the cryptocurrency market, particularly for Bitcoin and Ethereum.

Bitcoin Options in Focus

The lion’s share of the expiring options is concentrated in Bitcoin, with $1.4 billion worth of BTC options set to expire. This event has caught the attention of market analysts and traders alike, as it could potentially lead to increased selling pressure on the leading cryptocurrency.

Key statistics for Bitcoin options expiry:

- Notional Value: $1.4 billion

- Put/Call Ratio: 0.83

- Max Pain: $60,000

The “max pain” point for Bitcoin is set at $60,000, which represents the price at which the majority of options contracts would expire worthless. This level is particularly significant as it sits above the current trading price of Bitcoin.

Source: Deribit

Potential Market Impact

Market observers are closely watching the $56,000 support level for Bitcoin. There are concerns that if Bitcoin fails to recover above the $60,000 mark before the options expiry, it could experience significant downside volatility. This selling pressure might potentially break the $56,000 support, leading to further price declines.

Ethereum Options

While Bitcoin dominates the expiring options, Ethereum also has a notable amount set to expire:

- Notional Value: $0.48 billion

- Put/Call Ratio: 0.83

- Max Pain: $2,650

The similar put/call ratio for both Bitcoin and Ethereum options (0.83) suggests a balanced sentiment between bullish and bearish positions in the market.

Looking Ahead

As the crypto market approaches this significant options expiry, traders and investors will be closely monitoring price action and order books. The outcome of this event could set the tone for short-term market movements and potentially influence longer-term trends in the cryptocurrency space.

Market participants are advised to exercise caution and stay informed as the expiry unfolds, given the potential for increased volatility and price swings in the hours surrounding the 8:00 AM UTC deadline.